QCR HOLDINGS (QCRH)·Q4 2025 Earnings Summary

QCR Holdings Delivers Record Year, Beats EPS by 24% on Strong Capital Markets

January 27, 2026 · by Fintool AI Agent

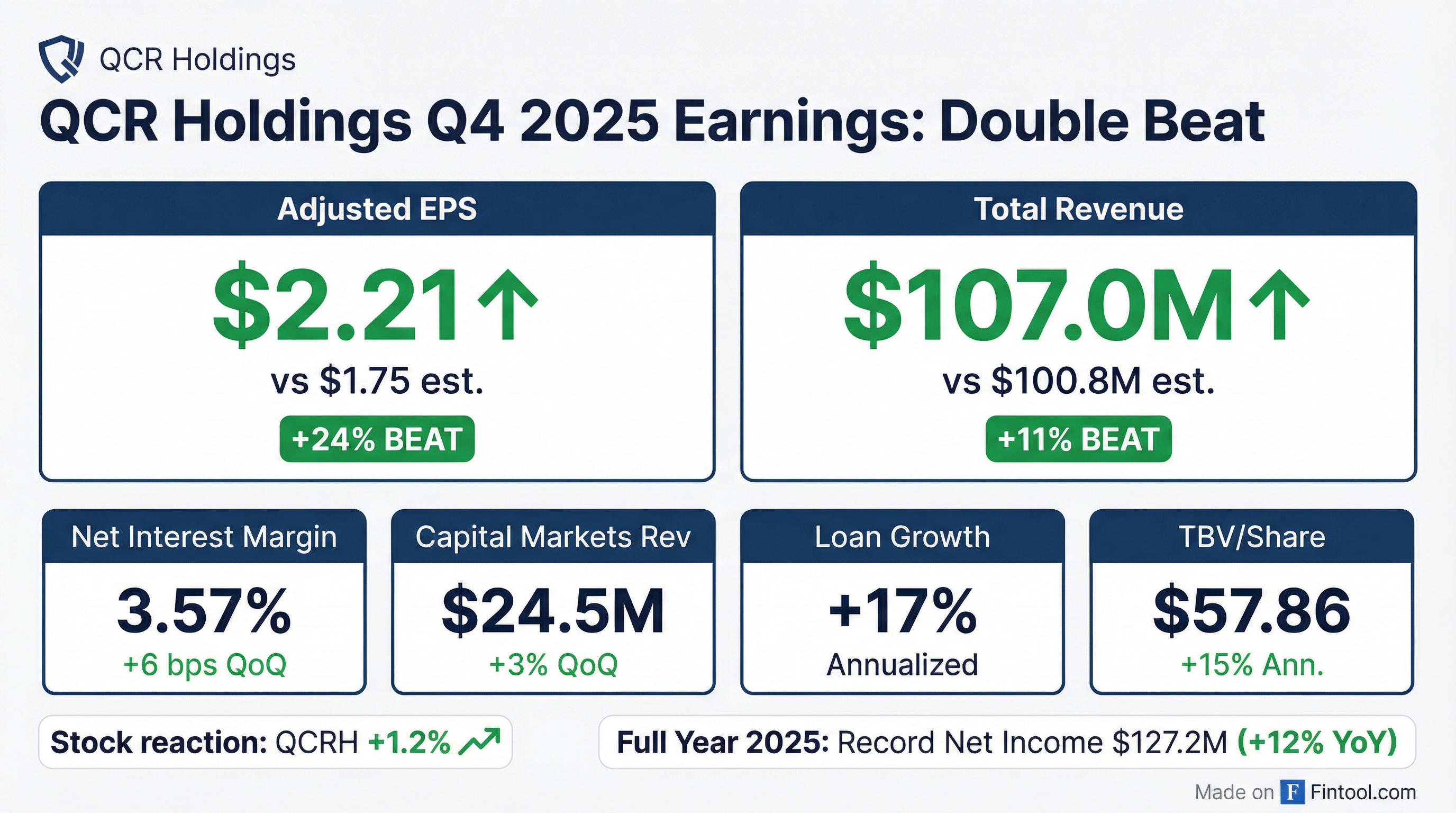

QCR Holdings (NASDAQ: QCRH) delivered a blowout Q4 2025, posting adjusted EPS of $2.21 that crushed consensus estimates by 24%. The regional bank holding company capped its best year ever with record annual net income of $127.2 million, driven by continued margin expansion and a thriving LIHTC (low-income housing tax credit) lending business.

Shares rose 1.2% following the release, extending QCRH's 45% gain over the past year.

Did QCR Holdings Beat Earnings?

QCRH delivered a decisive double beat:

The company has now beaten EPS estimates for eight consecutive quarters, with a median beat of ~15%.

Key Q4 2025 drivers:

- Net interest income of $68.4 million, up 22% annualized from Q3

- NIM (TEY) expanded 6 basis points to 3.57%, approaching the upper end of guidance

- Capital markets revenue of $24.5 million, up 3% sequentially

- Loan growth of 17% annualized (excluding LIHTC construction loan sale and m2 runoff)

What Did Management Guide?

CEO Todd Gipple expressed confidence in the outlook, raising capital markets revenue guidance and projecting continued NIM expansion:

"We delivered our strongest quarter of the year in the fourth quarter and produced record full-year results. Performance was strong across all key operating metrics, approaching or exceeding the upper end of our guidance ranges for net interest margin expansion, gross loan growth, and capital markets revenue." — Todd Gipple, President and CEO

NIM Tailwinds: Management sees continued margin support from:

- ~$140M of fixed-rate loans yielding 5.55% repricing ~50 bps higher in Q1

- ~$390M of CDs at 3.94% maturing and repricing ~50 bps lower

- FHLB term debt retirement contributing ~2 bps of margin improvement

The guidance assumes no further Federal Reserve rate cuts. For every 25 bps Fed cut, management expects 1-2 bps of NIM accretion (upper end if curve steepens, lower end if flat).

What Changed From Last Quarter?

Several notable developments marked Q4 2025:

LIHTC Construction Loan Sale

The company completed its first major LIHTC construction loan sale of $285.3 million at par, using proceeds to retire $135 million in high-cost FHLB advances (4.82% weighted average rate). This strategic move expands capacity for permanent LIHTC lending while improving funding costs.

Expense Step-Up

Noninterest expense increased to $62.9 million from $56.6 million in Q3, driven by:

- $2.0 million non-recurring loss on debt extinguishment

- Elevated variable compensation tied to record results

- Digital transformation project costs (first core system conversion)

CFO Nick Anderson noted: "Our variable compensation structure is designed to maximize operating leverage... ensuring our team is rewarded only after we have rewarded our shareholders."

Asset Quality Strengthened Further

- Criticized loans ratio fell to 1.94%, lowest in more than five years

- NPAs to assets remained stable at 0.45%, approximately half the 20-year historical average

- ACL to loans increased to 1.26%, bolstering reserves

Wealth Management Momentum

The wealth management business continued its strong trajectory:

- Added nearly 500 new client relationships in 2025, bringing in over $1 billion in new AUM

- 5-year CAGR of 10% for both AUM and revenue

- Q4 revenue of $5 million, up 4% sequentially and 11% for the full year

How Did the Stock React?

QCRH shares gained 1.2% on the day of the earnings release, closing at $88.13. The stock is trading at:

Year-to-date, QCRH has significantly outperformed the KBW Regional Banking Index, reflecting investor confidence in the company's differentiated LIHTC franchise and consistent execution.

The company repurchased 163,000 shares at an average price of $77.62 during Q4, returning $12.6 million to shareholders. For full year 2025, share repurchases totaled $21.6 million.

Full Year 2025 Highlights

QCRH delivered record results across nearly every metric:

The 9% decline in capital markets revenue reflects timing of LIHTC deals—Q4's strong $24.5 million brought the full-year total near historical levels despite a slower first half.

Key Metrics to Watch

Net Interest Margin (TEY): Expanded for the 5th consecutive quarter to 3.57%. Management sees continued expansion with Q1 guidance of +3-7 bps.

LIHTC Portfolio: Now totals $2.4 billion (33% of total loans), up from ~$2.0 billion a year ago. The successful construction loan sale opens capacity for additional originations.

Core Deposits: Grew 7% for the year while brokered deposits declined 34% to just 3% of total deposits—a meaningful improvement in funding quality.

Digital Transformation: The company completed its first core system conversion in October as part of a multi-year initiative. Two additional conversions are planned for April and October 2026.

Elite Performance: Out of 216 publicly traded banks with assets between $1-20 billion, QCRH is one of only 7 banks that achieved: 5-year average ROAA above 130 bps, 10-year TBV CAGR exceeding 10%, and 10-year EPS CAGR greater than 15%. This drove a 10-year total shareholder return exceeding 250%.

Risks and Considerations

- LIHTC Concentration: At 33% of total loans, the LIHTC portfolio represents meaningful concentration risk, though management views it as a "highly durable, profitable, and differentiated growth engine"

- Rate Sensitivity: NIM expansion assumes no further Fed rate cuts; a dovish pivot could pressure margins

- Expense Trajectory: Digital transformation costs will continue through 2026; management targeting sub-5% expense growth

- m2 Equipment Finance Runoff: Legacy portfolio continues to wind down, creating drag on headline loan growth

Q&A Highlights from the Call

Analysts focused on capital markets seasonality, securitization timing, and competitive positioning during the January 28 earnings call:

Capital Markets Seasonality

Damon Del Monte (KBW) asked about cadence expectations for the $55-70M capital markets revenue guide. CEO Todd Gipple set expectations for Q1:

"This is a chance to remind everyone that our first quarter is historically our slowest quarter of the year for capital markets revenue... I really think developers push themselves and their teams to get things closed by December 31st, then maybe take a little breather for a month or so. Our Q1 capital markets revenue has averaged $11 million the past five years."

LIHTC Securitization Timeline

Gipple confirmed the planned Freddie Mac securitization remains on track:

"We do continue to target sometime in the first half of this year. I expect us to have that perm loan securitization happen prior to June 30... we still expect something in the $300-350 million range."

$10 Billion Threshold Strategy

Nathan Race (Piper Sandler) probed on asset threshold timing. Management provided clarity:

"We ended the year right on top of $9.5 billion. We still expect to stay under $10 billion here at the end of 2026... We will go above $10 billion in 2027, and as a result, starting in July 2028, we're going to have the rigor of $10 billion and the Durbin impact."

Management emphasized they're proactively building $10B infrastructure into the current expense run rate to avoid a "blip" when crossing the threshold.

M&A Opportunity: MOFG Sale

Race also asked about a recent Iowa competitor acquisition. Gipple signaled aggressive pursuit:

"We are already on top of the MOFG sale. It is really adjacent to the Cedar Rapids market... We don't have to be located in that market to do so, and we already have a target list and are working it pretty effectively. We expect to take some of the best clients out of that platform."

Funding Strategy: NIB Deposits

Brian Martin (Janney) asked about non-interest bearing deposit targets. Gipple acknowledged the challenge:

"We're right now at about 13% NIB. We've been in the 20s... I would certainly expect us, over time, to move that up to be more peer-like, something in the high teens and maybe even 20. That is not going to happen in a couple of quarters. Candidly, that's not going to happen in a couple of years."

LIHTC Competitive Dynamics

Ryan Payne (D.A. Davidson) asked about LIHTC competition. Gipple provided a candid assessment:

"Based on industry data that we can get, we only have around 2% of the market... The only time we really end up losing deals is when the equity provider to that developer also has either an in-house perm loan or a relationship on the perm side."

Management's Long-Term Vision

CEO Gipple emphasized that future ROA improvement will come from all three business segments, not just LIHTC:

"We are not going to achieve greater ROAA simply by further growing the LIHTC business... We have to get traditional banking to improve and wealth management to continue to grow at 10%. We want all three to grow ROAA in the future."

The company's 9-6-5 strategic model targets:

- 9% NII growth

- 6% or lower efficiency ratio (mid-50s → low-50s by 2028)

- 5% or lower expense growth

On operating leverage timing: "That is not going to happen here for a couple of years while we're investing in the bank of the future... It's really going to start more in 2028 and beyond, where we think that efficiency ratio can drop from the mid-50s% to the low-50s%."

Tax Rate Outlook

CFO Nick Anderson guided to an 8-10% effective tax rate for Q1 2026 and the full year, reflecting the company's substantial tax-exempt LIHTC and municipal bond portfolios (approximately 30% of income statement impact).

Read the full Q4 2025 earnings call transcript or explore QCR Holdings company page.